-

Welcome to ASR. There are many reviews of audio hardware and expert members to help answer your questions. Click here to have your audio equipment measured for free!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Import Duties/Tariffs for the USA: The Basics (2025)

- Thread starter GXAlan

- Start date

- Status

- Not open for further replies.

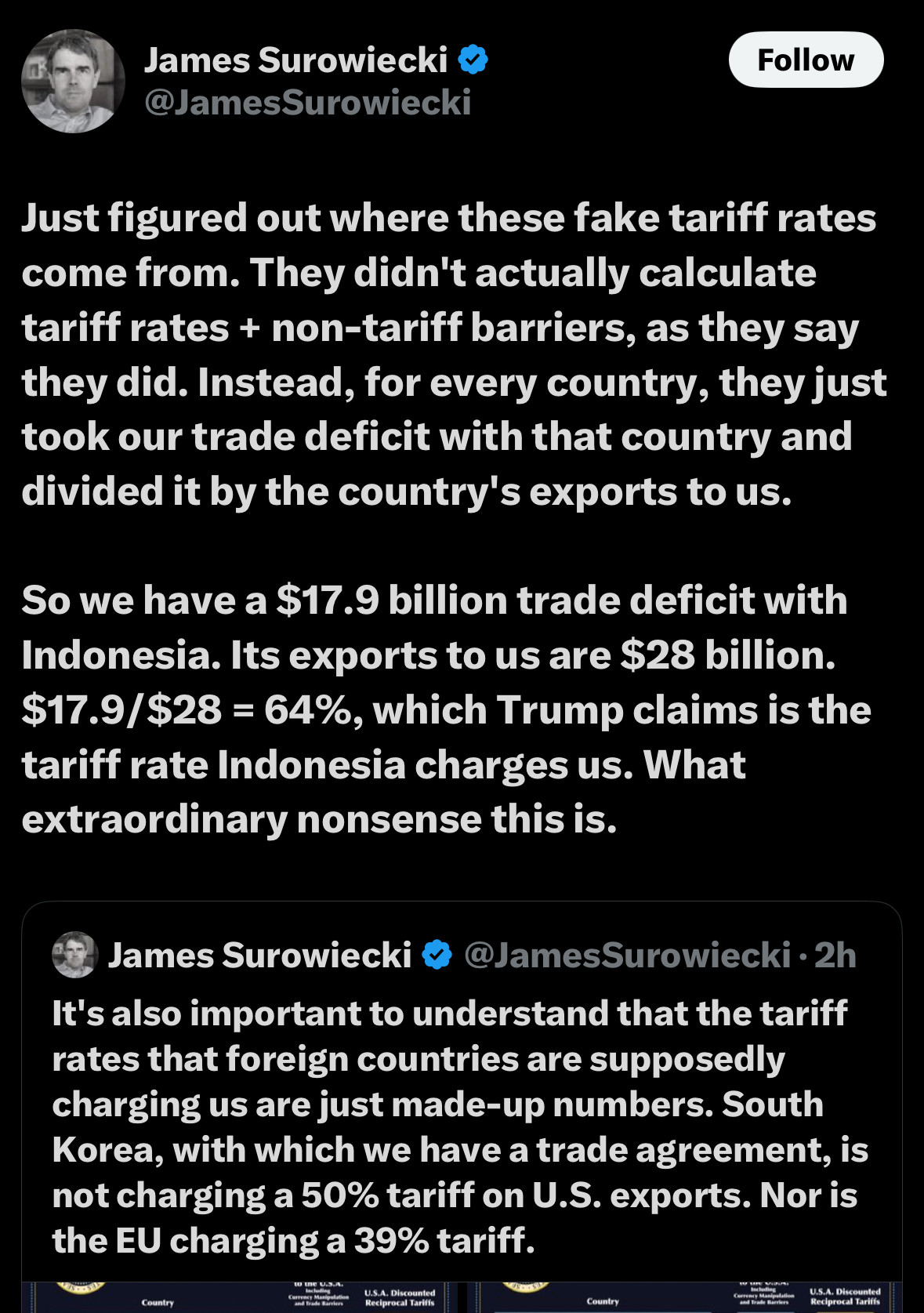

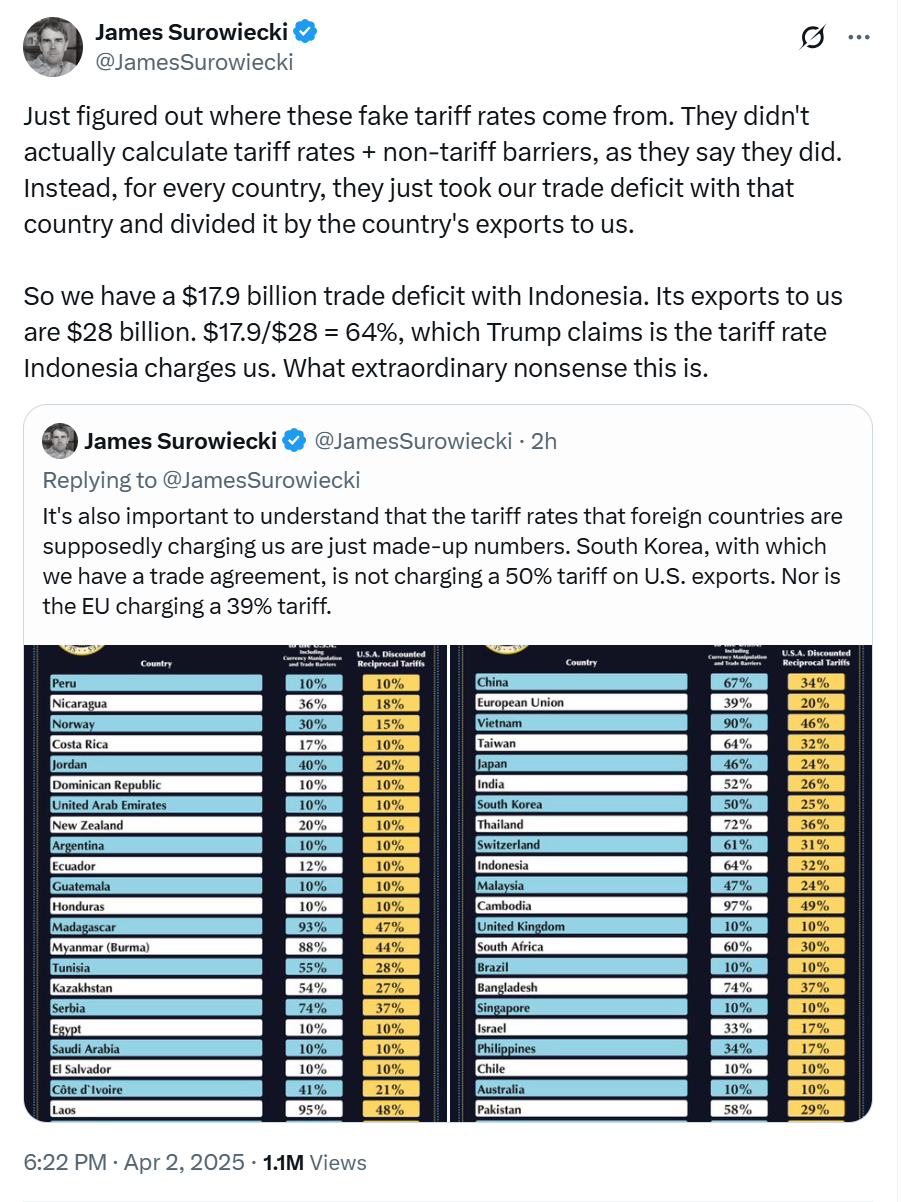

So EU 20% and Norway (where I'm from) 15%. Perhaps already mentioned but the table with the tariffs imposed on the US from other countries is just made up.

Norway has tariffs on some agricultural / foodstuff, but essentially 0% on almost everything else. if I purchase for instance electronics or even a car from the US, there are no tarrifs.

Norway has tariffs on some agricultural / foodstuff, but essentially 0% on almost everything else. if I purchase for instance electronics or even a car from the US, there are no tarrifs.

This looks like photoshop, but if it matches the data released by the White House, it has already been debunked. Apparently the US Trade Representative admitted as much but I can’t find the interview…Compare different country's average tariffs on USA next to the new tariff levy on that country. Source heading is included for establishing the data time stamp.

View attachment 441426View attachment 441427

Tariffs will be as effective as the Luxury Tax was.

But she explains it poorly. Tariffs lead to price increases and increased tax revenues (assuming the same amount of sales as before the tariffs were introduced). Then the extra inflow to the state treasury can, theoretically, be used to finance a reduction in income tax rates. That could lead to a different tax system, as economics professor Abigail Hall mentioned in my #60. But, we live in a different world now with a different type of trade than it was over a hundred years ago. So financing a society through tariffs seems a rather outdated, old-fashioned, backward approach.I'm not sure what you guys are worried about. These tariffs are tax cuts:

White House press secretary Karoline Leavitt says tariffs are ‘a tax cut.’ Economists say they aren’t - Poynter

Most economists say tariffs are tax hikes, not cuts, since the added costs are largely passed to consumers through higher priceswww.poynter.org

Furthermore, assuming the same amount of sales is just an assumption.

Of course, it is possible to finance tax cuts by taking out large loans. But hardly anyone wants a large debt. It is not fair to let future generations pay for today's party, so to speak.

That's how it's always been done in the past though.. It is not fair to let future generations pay for today's party, so to speak.

No, the foreign company does not get 120; they still get 100. The Federal Government gets the 20%, paid by the American people.Tariffs. You used to buy something for £100. The foreign company gets £100. Trump puts a 20% Tariff on it. Now you buy it for £120. The foreign company gets £120. You are out of pocket by £20. The US does not see the extra £20 you lost. In news elsewhere the new rates have been calculated as....

You were probably already paying some percentage tariff on it, it's just increased that's all. Federal government picks up the tariff money, assuming you still buy it at the new price. If you don't, then that creates a problem for the people who make it and the country it originates from.Tariffs. You used to buy something for £100. The foreign company gets £100. Trump puts a 20% Tariff on it. Now you buy it for £120. The foreign company gets £120. You are out of pocket by £20. The US does not see the extra £20 you lost. In news elsewhere the new rates have been calculated as....

Laffy (@[email protected])

Attached: 1 image Via Angry Staffer: I was thinking that none of those numbers made sense, but holy fuck this is insane #TrumpTax #tariffsmstdn.social

Sean Casten (@[email protected])

Attached: 1 image My word. They are dumber than I thought. And I thought they were really, really dumb.mastodon.social

It's just batshit stupid.

Yes the potential purchaser suffers from higher price and less choice but it's not all one way traffic. I wouldn't put too much faith in any commentator using language like 'dumb' or 'stupid'. It suggests a lack of any intelligent, educated analysis.

Let's not turn this into a US/Trump bashing thread, or we will simply close it.

Sokel

Master Contributor

- Joined

- Sep 8, 2021

- Messages

- 9,584

- Likes

- 10,279

It all comes to each importer's power.

If their only viable way to do business is to sell to US and some meaningful competition has grown between US vs others in terms of production then these importers will be the ones who will suffer.

The side effect of course will be increased prices any way, some of it will be absorbed by scale, some will be excused by the pride of US ownership, etc.

Dirt-cheap ones will remain dirt-cheap, I can't see a viable western company going for nearly no profit, not unless is planned to eradicate the competition of course as done in countries scale.

I would also trust the market, is far more brighter than any government and eventually will find its way. I would suggest people to wait a little, things will either explode or go back to usual, there's no middle ground to that.

If their only viable way to do business is to sell to US and some meaningful competition has grown between US vs others in terms of production then these importers will be the ones who will suffer.

The side effect of course will be increased prices any way, some of it will be absorbed by scale, some will be excused by the pride of US ownership, etc.

Dirt-cheap ones will remain dirt-cheap, I can't see a viable western company going for nearly no profit, not unless is planned to eradicate the competition of course as done in countries scale.

I would also trust the market, is far more brighter than any government and eventually will find its way. I would suggest people to wait a little, things will either explode or go back to usual, there's no middle ground to that.

Last edited:

It's a sensitive subject. It stirs up emotions. By the way, I certainly don't want to bash US.

I get that, but some are focused more on letting us all know where they stand politically than contributing meaningfully to the topic.

Those who can't manage it will have their posts deleted and be excused from the thread.

Let's not turn this into a US/Trump bashing thread, or we will simply close it.

Fun police!

Multicore

Major Contributor

- Joined

- Dec 6, 2021

- Messages

- 3,567

- Likes

- 4,284

The tariff exemption for small imports under USD800 goes away May 2 for shipments from China and HK.

- Thread Starter

- #73

Getting us back on topic... if you want to debate politics, create a new thread...

This is the list of exemptions that aren't affected by the 10% boost. There is some raw MDF and plywood, but the last page has this:

AKM DACs and TI amplifier chips fall under the exemption. HTS 85423900

HTS 8542900 seems to cover stuff like rotary encoders, but not stuff like HypeX modules.

Capacitors aren't under these exemptions (HTS 85322200).

This is the list of exemptions that aren't affected by the 10% boost. There is some raw MDF and plywood, but the last page has this:

AKM DACs and TI amplifier chips fall under the exemption. HTS 85423900

HTS 8542900 seems to cover stuff like rotary encoders, but not stuff like HypeX modules.

Capacitors aren't under these exemptions (HTS 85322200).

Someone figured it out.

Same for the EU, these numbers are forged, they added the 20% VAT tax as an import tax, just a pretext to add 20% tariff to the EU.

Really., I’m shocked……I’m shocked I say

Last edited:

Importing Audio Gear Into the USA (2025)

De Minimus Trade Exemption

If anyone you know traveled to Switzerland, they probably came home with some chocolate for friends and family. Theoretically, buying that chocolate overseas is no different than the Rolex example with an economic chain reaction of lost tax revenue. However, chocolate is pretty cheap and the actual cost to maintain and oversee duties is really not worth the effort. The idea that we shouldn’t sweat the small purchases/packages is what de minimis refers to.

If you are importing commercial quantities of chocolate, then yes, there are duties. Personal quantities? Not at all.

https://www.nftc.org/de-minimis-a-vital-tax-exemption/

How expensive would the cost be without de minimis? For something $50, you could end up paying another $47.23!

View attachment 426420

There needs to be some threshold where it doesn’t make sense to spend so much money to enforce the duties. Thats the idea of de minimis. Importantly, U.S. Customs and Border Protection are still responsible for screening these items and ensuring that illegal stuff isn’t being brought in, and that no one is sending stuff worth thousands of dollars and pretending that it’s just worth

This hassle of duties + tariffs + import documentation + making sure the person asking for your SSN is legit makes a lot of sense when there is a uniquely good deal or you are getting something that is otherwise unobtainable/rare in the United States. If there’s something available locally for only a tiny bit more, you may find it prudent to take the time to calculate the duties and other broker fees before proceeding.

TOO LATE- De minimus was eliminated staring Feb. The De minimi just added up to too much.

Saw the first post, haven’t had a chance to read through thread yet, wanted everyone to know De minimus is dead, and that 100s of scam firms have popped up to tell you that they can help you avoid all tariffs, duties, etc. Give them a credit card and your SSN.

This is from a vetted legal newsletter from a firm that specializes in this;

President Trump suspends Chinese-origin goods from de minimis entry

With growing support for action on de minimis entries across both parties and key Republican constituencies, attention quickly turned to what Donald Trump would do upon assuming the presidency on January 20, 2025. On February 1, 2025, Trump issued an executive order pursuant to the president’s authority under IEEPA directing the United States to impose a new ten percent tariff on all imports from China (including Hong Kong).2 The order also initially suspended access to customs de minimis entry for all covered products. When the China de minimis prohibition was in force, entries previously filed through carrier manifests or simplified Type 86 entries were required to file a formal entry and pay all duties and applicable fees. This not only meant paying the new ten percent duty, but also any other duties from which the import was previously exempted due to its de minimis status (including the Section 301 tariffs imposed during Trump’s first term). Similar executive orders imposing tariffs and prohibiting de minimis entry for imports from Canada3 and Mexico4 are suspended until March 4, 2025.Imports from China—the origin for the majority of de minimis entries5 —lost access to the de minimis entry system on February 4. CBP issued special guidance on the evening of February 3, stating that CBP’s Automated Commercial Environment (ACE) will automatically reject the de minimis clearance for ineligible shipments.6 The US Department of Homeland Security guidance for China (and Canada before its withdrawal) also stated that international mail would need to undergo formal customs entry processes. On February 4, the US Postal Service (USPS) briefly suspended parcel entry from China to comply with the directive. However, the action led to confusion and USPS restored service by February 5, stating, “USPS and Customs and Border Protection are working closely together to implement an efficient collection mechanism for the new China tariffs to ensure the least disruption to package delivery.”7 A few days later, on February 7, the White House acknowledged the challenges of suddenly ending de minimis entry, issuing an amendment to the original tariff order that suspended the original de minimis prohibition until the Secretary of Commerce sends notification to the president that “adequate systems are in place to fully and expediently process and collect tariff revenue […] for covered articles otherwise eligible for de minimis treatment.”8

There is a question on whether your package will even reach you, whether you have paid the tariffs or not.

Get an EIN

I did too, but back in September.This is why I stocked up on audio + electronics testing stuff back in December, now I'm holding out for the inevitable roll-rollback because the de minimis rule purge is going to absolutely smash customs with millions of new packages. But if that doesn't happen, there is also the weird option of importing stuff into Canada/Mexico/DR and then redirecting that into the US.

It has already smashed Customs and USPS.

This is very bad news for Apple. My last two iPhones were shipped directly from China and certainly had a cost of less than $800 for tariff purposes. This change in duties for under $800 items shipped to an address may be the worst part of the new tariffs for Apple.The tariff exemption for small imports under USD800 goes away May 2 for shipments from China and HK.

Look for this new tariff setup on under $800 items shipped to to be repealed soon. This repeal will not be to support poor little eBay sellers.

No. (UL isn’t an insurer). In the US it’s building codes, permits and inspections. If you build a movie theater every thing in there will need to be UL rated.From what I understand there is difference between US and EU rules. In the EU the safety rules are legislation, but in the US they are rules by the insurers (UL). I guess the latter makes it harder to stop their import. Am I right?

Most things coming in from overseas need no rating. It why you see “Hover boards” bursting into flames and burning homes at Christmas time (about 2016). Consumer Product Safety Commission had to step in (I don’t know if they exist anymore).

CE certification is completely different than UL certification. You can get a CR cert for export to EU based on plans, schematic. There are 100s of companies who will certify in US that are approved by EU.

On electrical, EU focuses on fire, US focuses on human life (what circuit breakers are required is good example).

- Thread Starter

- #79

TOO LATE- De minimus was eliminated staring Feb. The De minimi just added up to too much.

Saw the first post, haven’t had a chance to read through thread yet, wanted everyone to know De minimus is dead, and that 100s of scam firms have popped up to tell you that they can help you avoid all tariffs, duties, etc. Give them a credit card and your SSN.

Agreed. The first post was during the initial gap, but I should update it.

That said, de minimis was removed for China and Hong Kong but I don’t see that they removed it for EU or Japan, for example.

So EU 20% and Norway (where I'm from) 15%. Perhaps already mentioned but the table with the tariffs imposed on the US from other countries is just made up.

View attachment 441444

Norway has tariffs on some agricultural / foodstuff, but essentially 0% on almost everything else. if I purchase for instance electronics or even a car from the US, there are no tarrifs.

Correct me if I'm wrong. The following text is meant to be complementary to Norway.

Norway was and apparently still is, smart enough to stay out of the EU. This allows Norway to produce its oil and gas without limits from the EU. I believe Norway has been smart with its revenues and built-up a large sovereign wealth fund.

A relatively small population and the revenue from natural resources has been great for Norway and has allowed Norway a lot of flexibility in its dealings with the rest of the world including on imports, exports and tariffs. Most of Norway's neighbors in the EU are short natural resources, both energy and material.

Not being in the EU also allows Norway to subsidizes its farmers as it wishes without interference from the EU.

- Status

- Not open for further replies.

Similar threads

- Replies

- 47

- Views

- 6K

- Replies

- 2

- Views

- 2K

- Replies

- 60

- Views

- 34K

- Locked

- Replies

- 5

- Views

- 893

- Replies

- 46

- Views

- 5K