-

Welcome to ASR. There are many reviews of audio hardware and expert members to help answer your questions. Click here to have your audio equipment measured for free!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The wealth-building thread

- Thread starter JeffS7444

- Start date

From investopedia.com

I think the average age of the ASR membership is pretty high with many seniors here. If you have time to recover from losing 36%, the US market is a strong performer historically. And predicting the market up and downturns is not easy as many have said. Again, if you have large amounts money is in a US IRA where switching profitable Cap Stock ETFs to Fixed Rate and Government backed Bond ETFs for nice return (current ~4%) with no tax consequences is not a bad hedging strategy for protecting your next 10-20 years of living expenses. Let your excess and non IRA investments ride and If things look rosy then switch to other things with some the that conservative IRA money.

I've some BTC, the stock market has to become really wild to match the lows I've been through there.My investing strategy during previous downturns / recessions has been very simple: Look away! I don't attempt to predict the unpredictable.

But if someone starts sneezing you try to back off a little.

- Joined

- Jul 21, 2019

- Messages

- 3,016

- Likes

- 4,391

- Thread Starter

- #1,004

You know why I'm not expecting this to happen? It's runaway inflation, it would hurt consumers and investors quickly, while any growth of new jobs and industry would be a lot slower in coming (and someone else will get the credit!). Maybe we'd see an uptick in smuggling from Canada.If you are in need of electronics you might consider moving up the purchase to avoid possible Trump Tariffs. He is claiming 25% on Canada/Mexico and 35% on China will go into effect once in office. I doubt those will be the only countries impacted.

View attachment 409707

The items listed above are expected to experience some of the highest price increases. Economists predict that these tariffs could increase consumer prices by 1.4% to 5.1%, costing households between $1,900 and $7,600 annually. This inflationary effect is due to higher import costs being passed to consumers and less competition allows domestic producers to raise their prices. It might be a good time to purchase items you were already considering. Home appliances like refrigerators, washer, dryer would also see a significant price hike.

On the bright side, announcing these tariffs now will increase SPY earnings for the 4th quarter as a surge in purchases exceed previous projections to avoid expected price hikes (on just about everything). It's time to order my S&P500 "7000" T-shirt.

SPY = short term Bullish

GLD = short Term Bearish

- Joined

- Feb 23, 2016

- Messages

- 23,571

- Likes

- 44,326

Canada could sell their prescription drugs in the USA if smuggled effectively.You know why I'm not expecting this to happen? It's runaway inflation, it would hurt consumers and investors quickly, while any growth of new jobs and industry would be a lot slower in coming (and someone else will get the credit!). Maybe we'd see an uptick in smuggling from Canada.

- Joined

- Jul 21, 2019

- Messages

- 3,016

- Likes

- 4,391

- Thread Starter

- #1,006

I keep thinking back to my macroeconomics class in which the professor stressed on multiple occasions: Economies react better to gradual, predictable, shifts, rather than large and abrupt ones. And I think big businesses that have already made investments in areas like electric vehicles and complying with environmental regulations may prefer sticking to the status quo.

Yep, the S&P 500 has hit a record high about 50 times this year.S&P 500 closed at all time high today. Based on PAIN data, it's very possible Wed end of day could be flat to small 10-20 points down AND deeper red on Friday. Only to rally again next week.

It will be interesting to see if PAIN data plays out in this way.

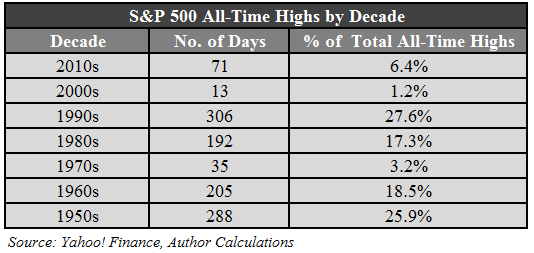

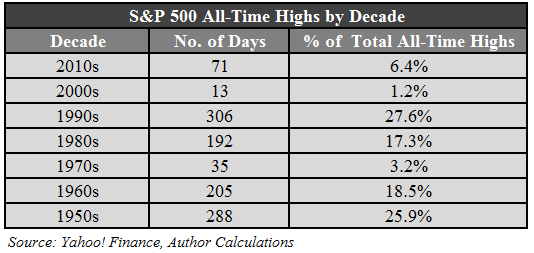

Bubble?Yep, the S&P 500 has hit a record high about 50 times this year.

I don't know. I don't care, either. Historically, the stock market has hit all time high quite often. I don't worry about what it's doing on any given day.Bubble?

I hope it works for you. I'm not smart enough to time the stock market.I only care when I'm looking for an entry point. From what I see the dip on Friday Nov28 could be the consolidation that moves SPY higher than 601. After that 601 may become the new support level.

See below, I believe this is the biggest problem with trying to time the market:

78% of the stock market's best days occur during a bear market or during the first two months of a bull market. If you missed the market's 10 best days over the past 30 years, your returns would have been cut in half. And missing the best 30 days would have reduced your returns by an astonishing 83%.

78% of the stock market's best days occur during a bear market or during the first two months of a bull market. If you missed the market's 10 best days over the past 30 years, your returns would have been cut in half. And missing the best 30 days would have reduced your returns by an astonishing 83%.

Bubble?

All-Time Highs in the Stock Market are Perfectly Normal - A Wealth of Common Sense

“If you think the market’s “too high” wait ’til you see it 20 years from now.” – Nick Murray In late July the S&P 500 closed at an all-time high level of roughly 1,988. It was the 26th all-time high based on the closing price for the S&P in 2014 alone. Because we’ve seen all-time highs in...

awealthofcommonsense.com

awealthofcommonsense.com

That's a variation on my strategy. I only check my accounts when my holdings are going up.My investing strategy during previous downturns / recessions has been very simple: Look away! I don't attempt to predict the unpredictable.

Agree with this but in my post above in shows a down market lasts an ave. of 17 mo. and average loss of 36% but what is not shown is that one has is how long it take on average to recover that 36% plus that 17 mo. If one is 50years old that's one thing but if one is 70 and living on that income for another 20 years that's another. An up market after big loss is a good thing for sure if one has the time funds to wait it out. Hedging for both situations is the way to go if one needs the dough. IMO

All-Time Highs in the Stock Market are Perfectly Normal - A Wealth of Common Sense

“If you think the market’s “too high” wait ’til you see it 20 years from now.” – Nick Murray In late July the S&P 500 closed at an all-time high level of roughly 1,988. It was the 26th all-time high based on the closing price for the S&P in 2014 alone. Because we’ve seen all-time highs in...awealthofcommonsense.com

I would address this by asset allocation and portfolio risk, independent of market level/highs/lows.

This can also depend on the size of the portfolio relative to needs. If you have a huge portfolio, it doesn't matter what you do. You can take minimal risk and have enough or take lots of risk, still have enough, and maybe have more. For most of us, the portfolio isn't that big, so asset allocation becomes more conservative as we age.

This can also depend on the size of the portfolio relative to needs. If you have a huge portfolio, it doesn't matter what you do. You can take minimal risk and have enough or take lots of risk, still have enough, and maybe have more. For most of us, the portfolio isn't that big, so asset allocation becomes more conservative as we age.

Agree with this but in my post above in shows a down market lasts an ave. of 17 mo. and average loss of 36% but what is not shown is that one has is how long it take on average to recover that 36% plus that 17 mo. If one is 50years old that's one thing but if one is 70 and living on that income for another 20 years that's another. An up market after big loss is a good thing for sure if one has the time funds to wait it out. Hedging for both situations is the way to go if one needs the dough. IMO

And maybe selling and profit taking in early 2025 to offset write-offs where many predicting a down turn.Look out below?

SPY MaxPain = 596 today.

Current price = 605.66

Wouldn't be surprised if a bit of profit taking happens in the last 17 days of 2024. 28% annual return on SPY is crazy high.

MaxPain currently quoted at 575 on Dec 20 - one week from today. Could be interesting next two weeks.

- Joined

- Jul 21, 2019

- Messages

- 3,016

- Likes

- 4,391

- Thread Starter

- #1,017

If everything worked out exactly, roughly how much $ might a person gain on an investment of $1K, once transaction fees and taxes were considered?Nice PUKE on SPY.

We need more 1% down days.

SPY 594 looks like a buy for me.

Hope to ride it to 606 next Tuesday?

Wow 588. lol

Fun days for the BEARS!

That all depends on how you want to play it. For all practical purposes commission are $0.00 so if you are just buying and selling the ETF's and bought at 594 and sold at 606 you would make 2% or $20. If you used 50% margin on ETF's you could make 4% or $40. If you are playing the futures with 10% margin then you could make $200. If you are trading short dated options it could be much higher but with a very small chance of "winning". With no margin the most you can lose is your investment, with margin you can lose more than your investment, with options you can only lose your investment.If everything worked out exactly, roughly how much $ might a person gain on an investment of $1K, once transaction fees and taxes were considered?

- Joined

- Jul 21, 2019

- Messages

- 3,016

- Likes

- 4,391

- Thread Starter

- #1,020

Thanks for that clarification; the fact that I still don't fully understand the appeal in light of the risk, tells me that I got no business getting into it!That all depends on how you want to play it. For all practical purposes commission are $0.00 so if you are just buying and selling the ETF's and bought at 594 and sold at 606 you would make 2% or $20. If you used 50% margin on ETF's you could make 4% or $40. If you are playing the futures with 10% margin then you could make $200. If you are trading short dated options it could be much higher but with a very small chance of "winning". With no margin the most you can lose is your investment, with margin you can lose more than your investment, with options you can only lose your investment.

Similar threads

- Replies

- 100

- Views

- 20K

- Replies

- 1

- Views

- 495

- Replies

- 3

- Views

- 1K

- Replies

- 3

- Views

- 920