Selling a pair of 8C Studio's

www.usaudiomart.com

www.usaudiomart.com

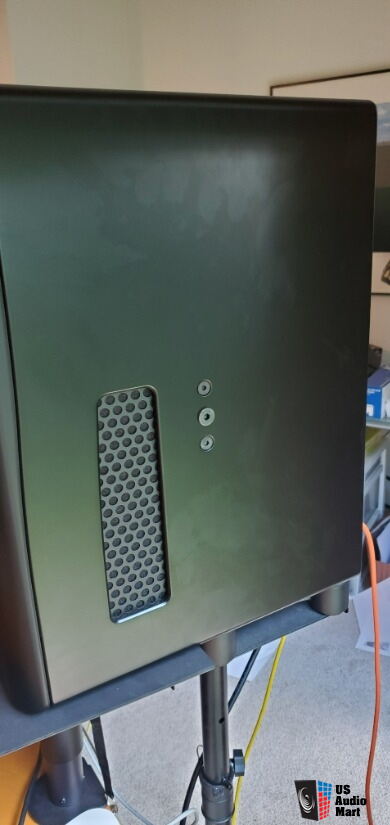

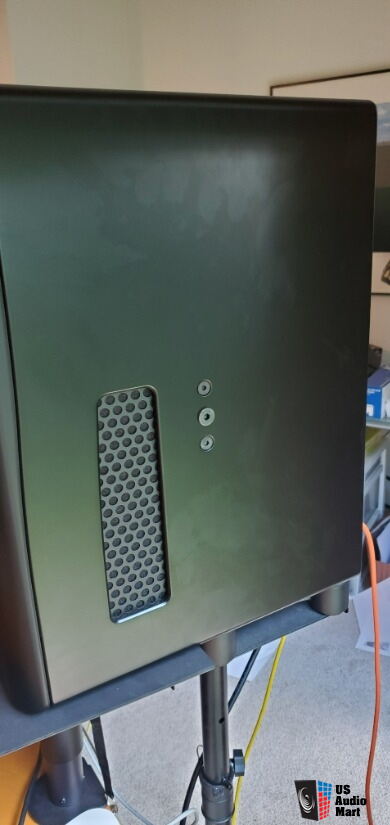

FS: Dutch & Dutch 8C Studio pair

FS: pair of D&D 8C Studio monitors. I originally bought 2 pairs for home theater, only going to keep 1 pair. Price includes freight shipping & insurance to CONUS - Zelle/Venmo (no fee) and/or Local pickup (60174) will have lower pricei'm the original owner, purchased in November '22....